how is capital gains tax calculated in florida

Schedule D Form. Your gain can be taxed as either a long-term or short-term capital gain.

Florida Real Estate Taxes And Their Implications

Individuals and families must pay the following capital gains taxes ncome up to 40400.

. The basic rule for calculating capital gains is the sales price minus the cost of selling less the adjusted tax basis cost basis which equals the taxable capital gain or loss. This is the total amount of your capital. A capital gains tax is a tax on the profit from the sale of an asset.

Capital gains are calculated as the sale price of the asset minus the adjusted basis. If you sell collectibles art coins etc your capital gains tax rate is a maximum of 28. The adjusted basis is.

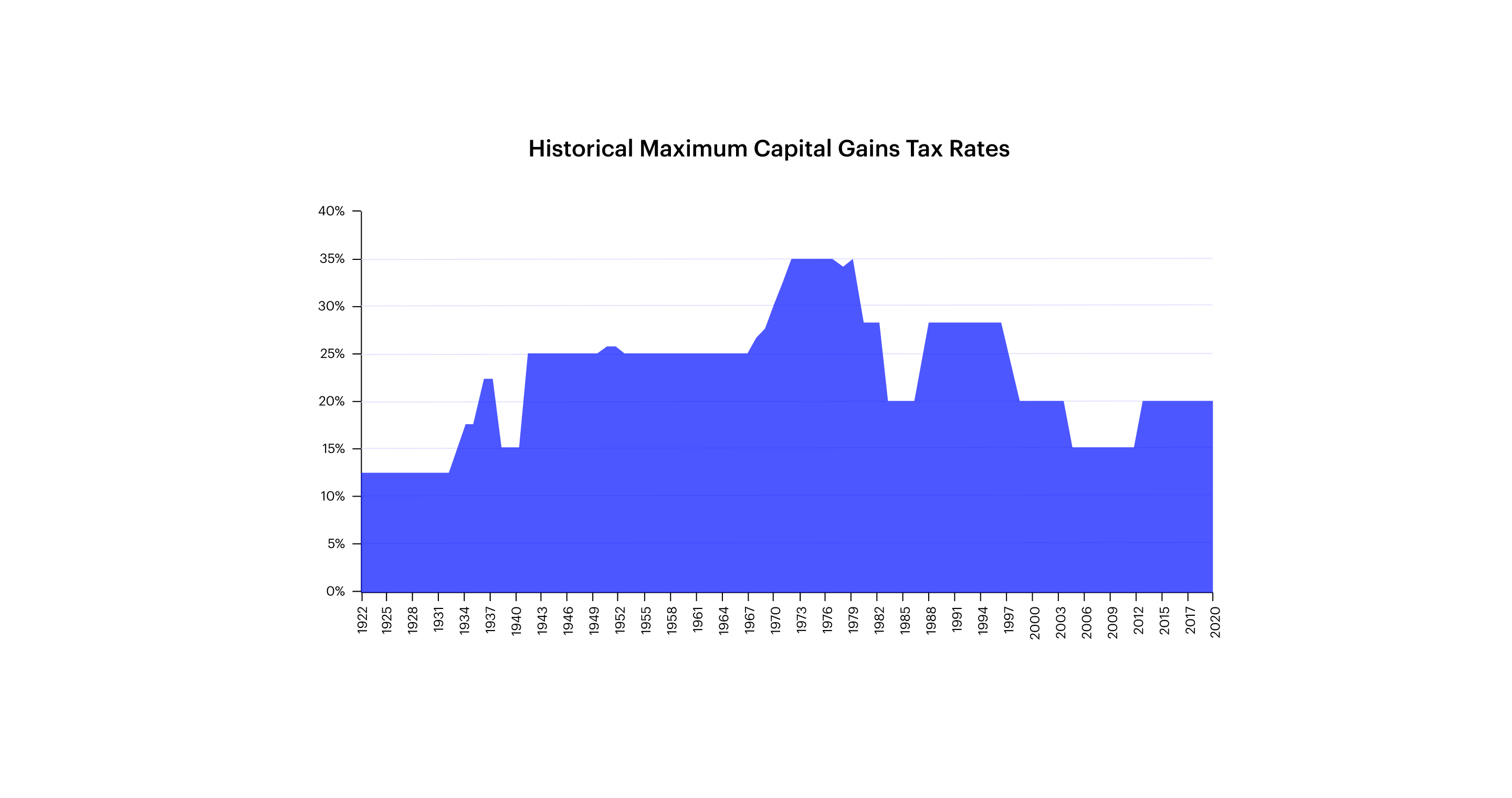

Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. Long-term capital gains tax.

For example if you bought a home 10 years ago for. The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for adjusting for. Subtract this adjusted cost basis from the amount you received when selling your home.

Favorable long-term capital gains tax rates apply only to profits from the sale. This depends on several factors including. By comparison states with high income tax California New York Oregon Minnesota New Jersey.

The state of florida does not have an income tax for individuals and. Our income tax and paycheck calculator can help you understand your take home pay. The total of these items is the adjusted cost basis of your home.

Not All Profits Are Taxable. 500000 of capital gains on real estate if youre married and filing jointly. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Cryptocurrency Tax Calculator Capital Gains Tax Calculator. Capital gains tax is calculated using your profits and income to determine your taxable income which is then multiplied by the rate that you have to pay. Your federal tax bracket Your.

A florida capital gains tax calculator will help you estimate and pay taxes based on your situation. Capital Gains Tax Exemption When selling your house in Florida you can exclude a high portion of your profits given specific conditions are met. The amount you paid for the asset Minus depreciation for.

Capital gains tax rates for companies are equal to the ordinary corporate income tax rate. Because Florida doesnt have a capital gains tax the amount you pay depends on the federal tax rates. Wash Sale Definition and Entry.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The investors regular income tax bracket applies to short-term capital gains which is usually higher than the capital gains tax rate unless a taxpayer is in the highest. C corporations can deduct regular expenses from their ordinary income but thats.

Long Term Capital Gains Example. Capital gains are the profits you earn between the time you purchase an investment and the time you sell it. The tax is calculated based on the gains the sale.

If your taxable gains come from selling qualified small business stock section 1202. 250000 of capital gains on real estate if youre single. The most common asset that is taxed is real estate.

A long-term capital gain is the profit realized on the sale of a security held for more than one year. New Hampshire for example doesnt tax income but does tax dividends and interest. The purpose of investing is to grow your wealth and therefore its to be expected.

Florida does not have state or local capital gains taxes.

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax Calculator Estimate What You Ll Owe

Qualified Dividend And Capital Gains Tax Worksheet Youtube

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

The States With The Highest Capital Gains Tax Rates The Motley Fool

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

2022 Capital Gains Tax Calculator Personal Capital

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

Foreign Capital Gains When Selling Us And Foreign Property

Capital Gains Tax In The United States Wikipedia

How To Calculate Capital Gains Tax H R Block

State Taxes On Capital Gains Center On Budget And Policy Priorities

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

Capital Gains Tax What Is It When Do You Pay It

Florida Real Estate Taxes What You Need To Know

How To Calculate Capital Gains Tax H R Block

Tax Implications Of Canadian Investment In A Florida Rental Property